Auto Insurance

You are a responsible driver but it’s everyone else we’re worried about.

No matter where the road takes you, we are committed to making sure you have the COVERAGE you need and the Discounts you deserve. There is a difference between simply having coverage and having the right coverage.

The right amount of coverage is essential. Our relationships with major carriers saves you time and allow us to help you secure the right coverage at the right price.

-

Liability

-

Medical

-

Collision

-

Un or under-insured

-

Comprehensive

-

Roadside/Gap/Rental

-

Liability

-

Medical

-

Collision

-

Uninsured/Underinsured

-

Comprehensive

-

Roadside/Gap/Rental

Understanding Coverages

Liability (required by law)

For at-fault repairs & medical care.

Bodily Injury and Property Damage Liability

Coverage protects you if you cause an accident; you insurance pays for the other parties medical bills (passengers' bills, too) and any damage.

Uninsured / Underinsured Bodily Injury

For not-at-fault medical care. Coverage protects you if you're in an accident caused by a driver who either has no insurance or just not enough insurance. Your insurance pay for damages you incur, including medical expenses and lost wages.

Medical Payments

For any post-accident medical expenses. This protects you if you're in an accident; typically to coverer expenses that your primary health insurance doesn't.

Collision

For any post-accident repairs. Collision coverage protects you if you are in an accident; your insurance carrier pay for your car repairs. You choose a deductible and pay this portion to the repair shop after an accident, your insurance carrier pay the rest of the bill.

Comprehensive

For any other repairs. Comprehensive coverage protects you if your car is damaged by something other than a collision, such as fire, vandalism, hail or flood; your insurance carrier pays for repairs (after you pay the deductible).

Uninsured Motorist Property Damage

For unpaid not-at-fault damage. Uninsured Motorist Property Damage coverage protects you if you're in an accident caused by a driver who doesn't have insurance; your insurance carrier will pay to repair damage to your vehicle (after you pay the deductible).

Roadside Assistance

For breakdowns. Roadside Assistance coverage protects you if your car breaks down due to mechanical or electrical issues like a dead battery, a flat tire, or a lock-out, or if you run out of gas. Your insurance carrier pays for towing services or roadside help.

Gap Insurance

For your car loan. Gap Insurance, protects you if your car is ever declared a total loss; we pay up to 25 percent over the actual cash value towards the amount you owe the lender.

Rental Coverage

For car rental. This protects you if your car is being repaired as part of a Comprehensive or Collision claim; most carriers will pay for up to 30 days of a rental.

Understanding Coverages

A business like yours needs a partner like us.

We will customize a business auto insurance policy to fit your company's specific needs. We offer coverage for a wide variety of industries and vehicles so that your business is always protected. The low rates and excellent service you'll provide the kind of peace-of-mind only Johnston Insurance can offer.

From plumbing contractors to high-tech start-ups, we provide business auto protection for virtually every type of business including yours.

Below is just a partial list of the business categories we cover:

-

Artisan Business/Service Contractor

-

Catering Business

-

Construction

-

Farming

-

Office

-

Pest Control

-

Retail

-

Sales/Marketing Professionals

-

Wholesale

From small delivery vans to tractor-trailers, we insure a wide variety of business vehicles, including…

-

Passenger Vehicles

-

Vans, Pickups and SUVs

-

Flatbeds and Stake Trucks

-

Box Trucks

-

Refrigerator and Utility Trucks

Your agent will work with you to design the best, most appropriate coverage package for your business. Some of our most common coverages include…

-

Liability

-

Collision

-

Comprehensive

-

Medical

-

Personal Injury Protection

-

Uninsured / Underinsured

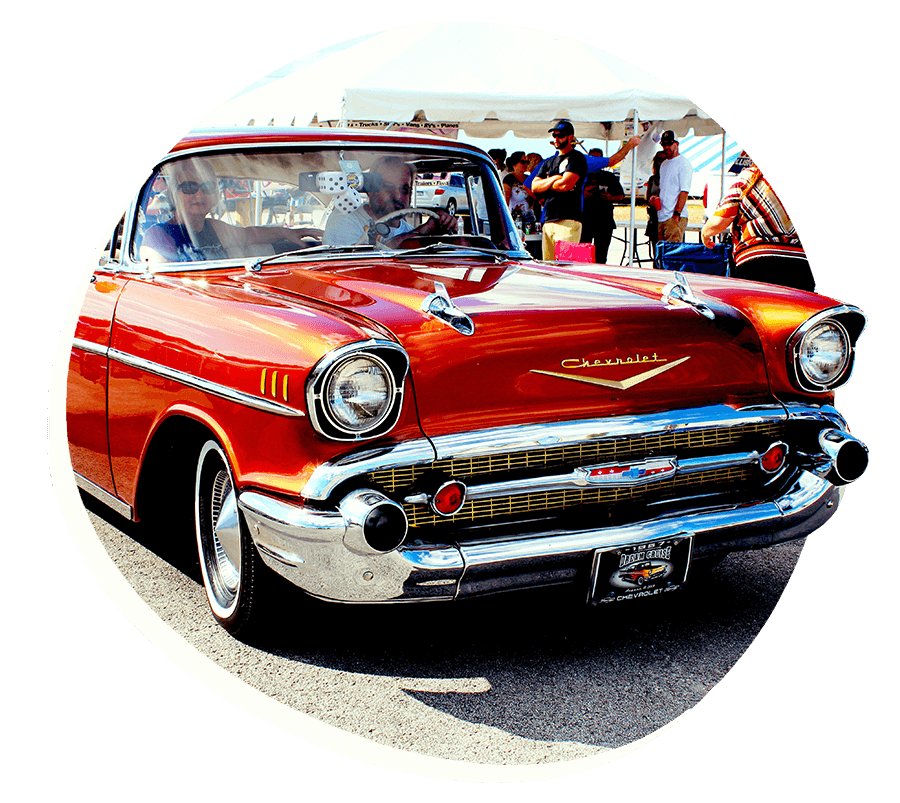

Classic & Custom Cars

Whether you lovingly rebuilt your antique auto or classic car from the ground up or you bought a perfectly restored showpiece, it's much more than a car to you. It's your passion, your pride and joy.

The truth of the matter is, we offer specialized classic car insurance coverage you just won't find anywhere else. Our goal is to offer our clients a tailored old car insurance coverage plan that is unique as the collection in their possession; coverage which will help them protect and pass on the legacy they have worked so hard to build.

Available Coverages:

-

Liability

-

Collision

-

Medical Payments/No Fault

-

Uninsured Motor Vehicle/Underinsured Motor Vehicle

-

Comprehensive

-

Emergency Road Service

-

Liability

-

Collision

-

Medical Payments/No Fault

-

Uninsured Motor Vehicle/Underinsured Motor Vehicle

-

Comprehensive

-

Emergency Road Service

Need a specific quote for Commercial Auto?

Just click the button and fill out the form to get started.

J JOHNSTON INSURANCE

10900 Los Alamitos Blvd., Suite 217 Los Alamitos, CA 90720

Phone: (562) 795-9201

Phone: (562) 795-9121

Office Hours:

Monday - Friday / 8am - 5pm

License # OF44179